[7 min read]

A certificate of origin (C/O) in Vietnam is an important document that allows exporters to enjoy certain tax incentives and/or other preferential treatment. This document is needed for the increasing wave of production lines transferring from China to Vietnam.

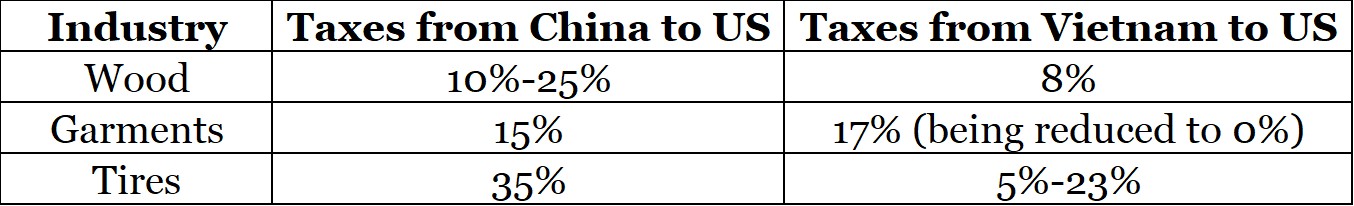

Take a look at the table below that illustrates the taxes imposed on commodities exported from Vietnam and China to the US market:

Data from different sources

To have a better understanding of C/O licensing in Vietnam and what is needed for the entire procedure, there are six points businesses should pay attention to, based on our experience.

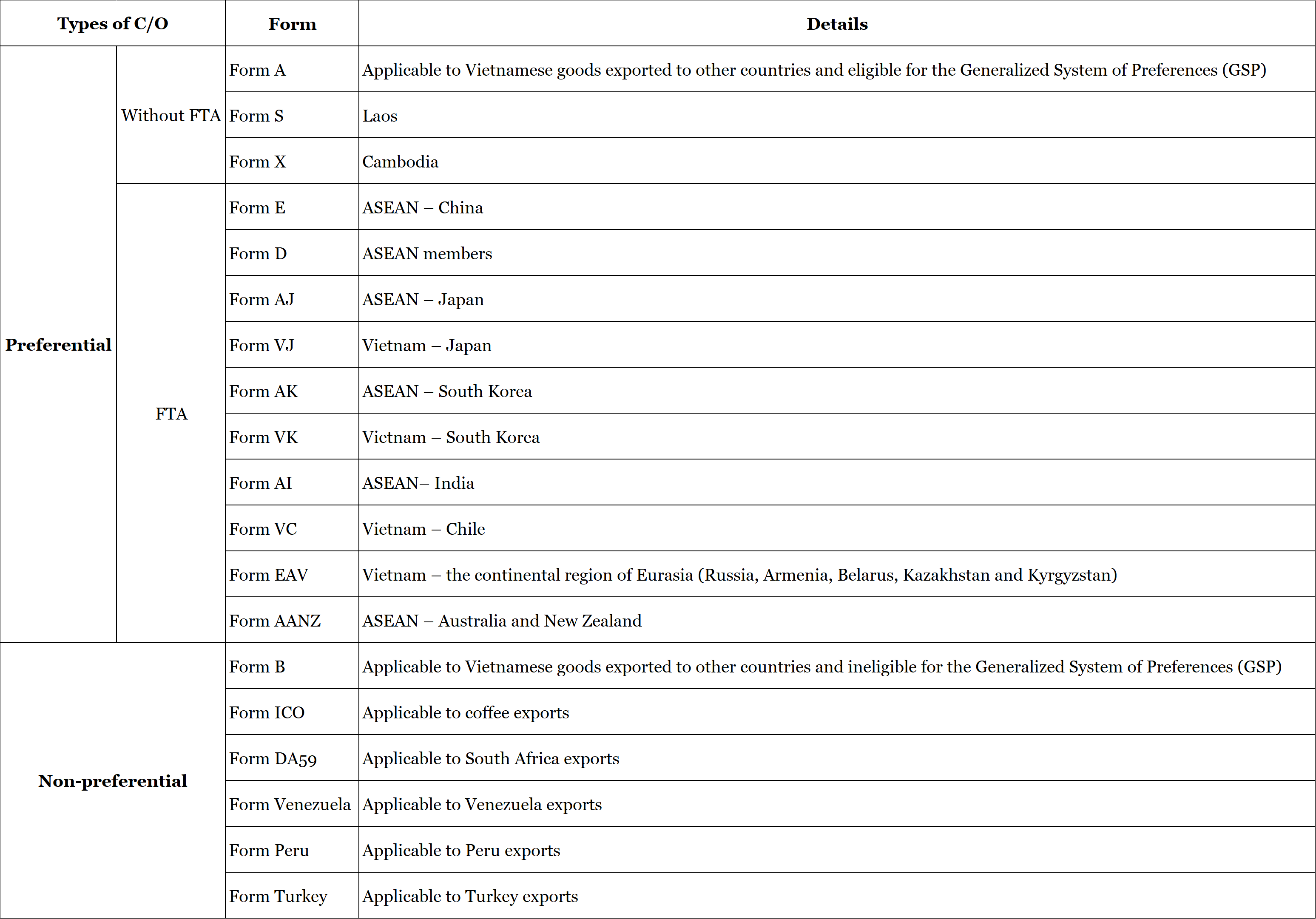

1. Types of C/O in Vietnam

The table below shows a summary of C/O types in Vietnam:

Common C/O in Vietnam categorized by top importing countries are:

1. Form A

2. Form E (ATICA – China)

3. Form AK (ASEAN – Korea)

4. Form AI (ASEAN – India)

5. Form AANZ (ASEAN – Australia – New Zealand)

6. Form AJ (ASEAN – Japan)

7. Form EUR.1 (EVFTA)

2. Which type of C/O is used for exports to the US?

The US has remained the largest export market of Vietnam for many years. As Vietnam and this country have not entered any free trade agreement, our research shows the Form B: C/O that is used for all kinds of goods exported to other countries and issued under non-preferential rules of origin is suitable for exports to the US.

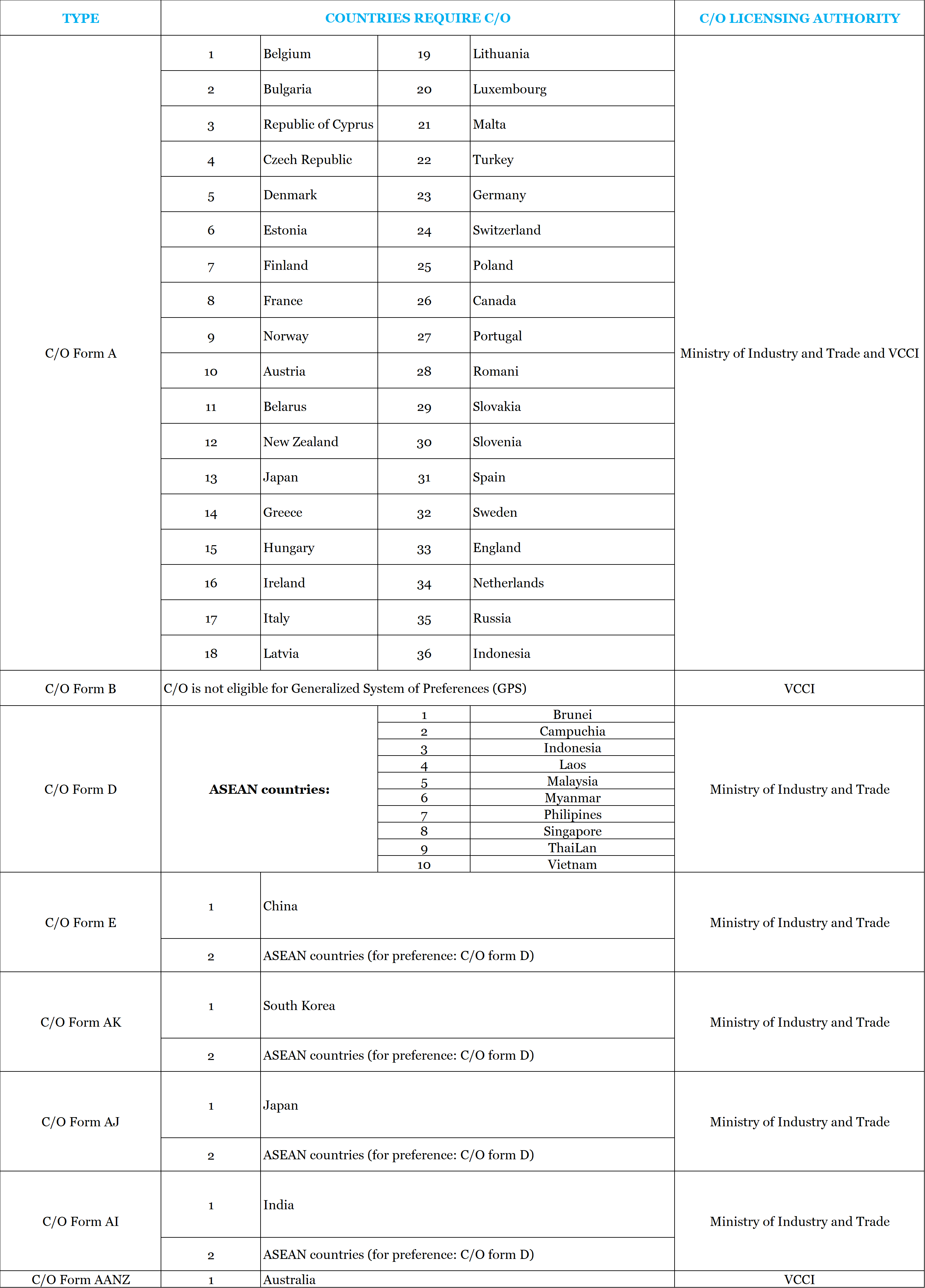

3. Who issues C/O in Vietnam?

4. What is a change of tariff classification (CTC)?

A change in tariff classification means that the tariff classification of the final product is different from the tariff classification of all non-originating materials used. The minimum requirement for a change is defined by the rule of origin and may take place at different levels: chapter (two-digit level), heading (four-digit level), or sub-heading (six-digit level). In other words:

– Change in chapter (CC) means that all non-originating materials are not classified in

the same chapter as the final product.

– Change in tariff heading (CTH) means that all non-originating materials are not

classified in the same heading as the final product.

– Change in tariff sub-heading (CTSH) means that all non-originating materials are not classified in the same sub-heading as the final product.

5. Procedure for the issuance of C/O

This procedure includes three steps:

Step 1: Registration of trader dossiers (required)

A trader dossier comprises:

– Registration of the specimen of the signature of the person authorized to sign the C/O application and the specimen of the trader’s seal.

– Certificate of business registration of the trader (a certified true copy).

– Certificate of tax identification number registration (a certified true copy).

– A list of production establishments of the trader (if any).

Note:

– Any changes in the trader dossier shall be promptly notified to the C/O issuer where this dossier has been registered. A trader dossier shall be updated once every two years.

– C/O applicants are considered for C/O issuance only at the places where they have registered their trader dossiers and after they have completed trader dossier registration procedures.

Step 2: Record officers receive and examine these dossiers.

Step 3: C/O is granted.

6. C/O application dossiers

A C/O application dossier is comprised of:

– The C/O application form that has been fully and duly filled in (one original form and three copies).

– The export customs declaration for which customs procedures have been completed (a copy signed by a competent officer and stamped

“certified true copy”).

Notes:

• This declaration is not required for exports that are not subject to customs declaration under la.

• In case of a plausible reason, the C/O applicant may submit these documents later than 30 days from the date of C/O issuance.

– Some other necessary documents that the C/O-issuing authority deems necessary include the customs declaration of imported materials and auxiliary materials, export permit, sale contract, VAT invoice on the purchase and sale of domestic materials and auxiliary materials, sea waybill, air waybill and other documents proving the origin of exports.

7. C/O issuance time

– A C/O shall be issued within three working days after the C/O applicant files a complete and valid dossier.

– In case of need, the C/O issuer may conduct verification at production establishments if they deem the dossier examination provides insufficient grounds for C/O issuance or when they detect signs of violation of the law. Verification results must be recorded in minutes and jointly signed by the verifiers, C/O applicants and/or exporters. In case the applicants or exporters refuse to sign these minutes, the verifiers shall write the reasons for such refusal in the minutes and sign them for certification. The time limit for issuing or refusing to issue a C/O, in this case, shall not exceed five working days after the applicant files a complete dossier.

– It is worth noting that in no event shall the verification impede the delivery or payment by exporters unless it is due to the fault of the exporters.