[5 min read]

According to reports from the General Statistics Office, FDI in Vietnam is on the upswing — reaching 38 billion USD in 2019 — an increase of 7.2% compared to 2018. There are many reasons for this impressive FDI figure, one of which Vietnam young and huge labor force — an significant advantages compared to other developing nations in Southeast Asia. Vietnam ranked as world’s 14th most populous country in 2019, with 97 million people with an average age 32 years old and 77% participation in labor force.

GENERAL INFORMATION

According to US News and World Report, Vietnam is ranked eighth among the best 29 economies to invest in and is first among ASEAN countries in attracting foreign investment. These rankings are a result of a survey of 7,000 business planners based on eight criteria: economic stability, favorable tax environment, skilled labor force, technological capacity, entrepreneurship, innovation, dynamism, and corruption.

In a survey conducted by NNA Japan Co., a company of Kyodo News Corp, from November to December 2019, Vietnam received 42.1% among 820 valid responses voting for the investment destination in Asia with the most potential, which demonstrates the potential of an emerging market and an abundant labor supply at competitive costs.

In addition to competitive labor costs, the importance of labor quality in attracting FDI is widely understood — especially in high-end industries such as automotive, computers & electronics, electrical equipment, and advanced materials.

The below article provides an overview of Vietnam’s labor law, including minimum wage, personal income tax and working hour regulations.

WAGES

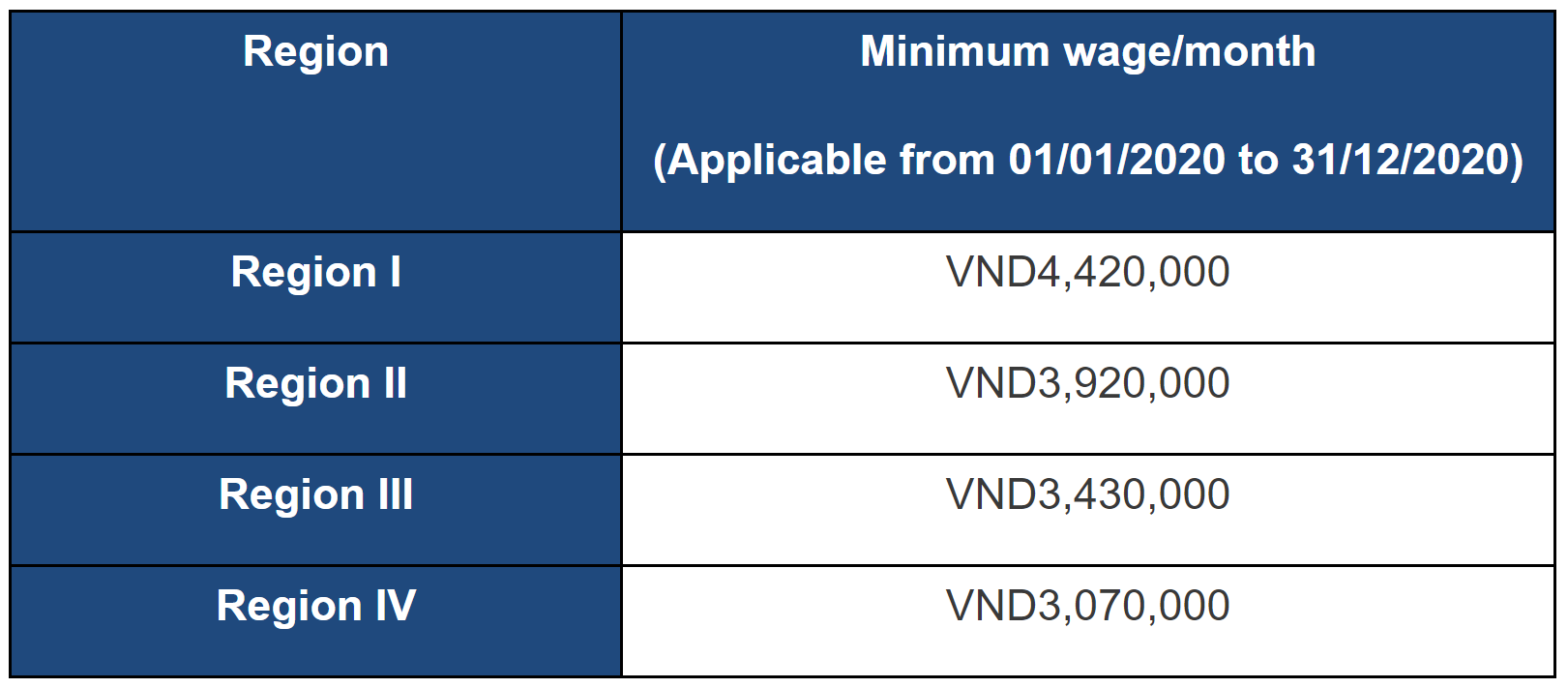

According to Decree 90/2019/NĐ-CP, the regional minimum wage was increased as of January 1, 2020.

According to Decree 90/2019/NĐ-CP, the regional minimum wage was increased as of January 1, 2020.

-

- Region I consist of cities and provinces with the highest cost of living, such as urban districts in Hanoi and Ho Chi Minh City — or neighboring provinces such as Dong Nai, Binh Duong and Vung Tau

- Region II includes the outskirts of Hanoi and Ho Chi Minh City as well as other large and medium-sized cities throughout Vietnam such as Da Nang, Nha Trang and Can Tho.

- Region III includes smaller provincial cities and suburban districts.

- Region IV includes all remaining areas.

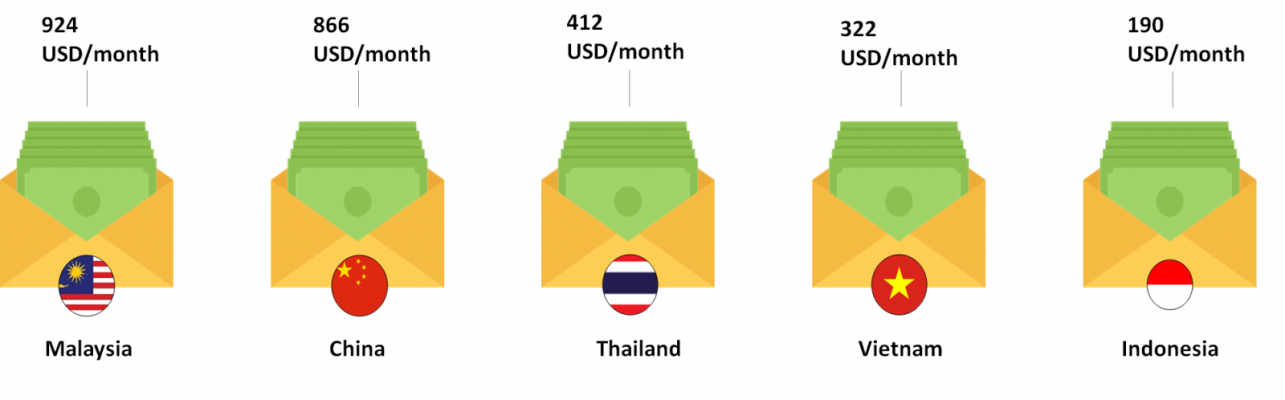

Regarding the average labor cost, Vietnam has attractive average wages among other emerging economies. Below is a comparision table according to BW’s market research department

PERSONAL INCOME TAX (PIT)

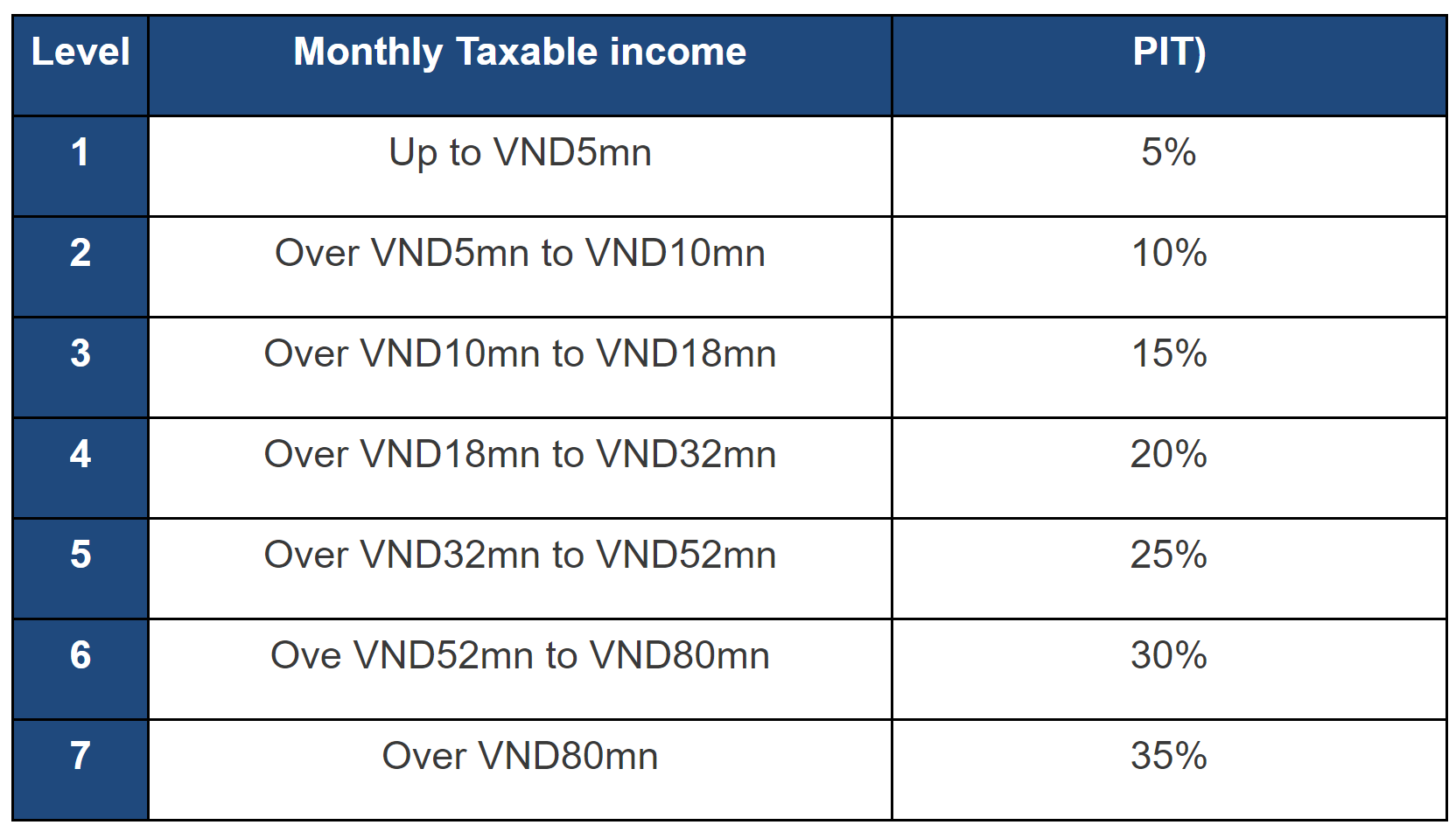

According to Circular 111/2013 / TT-BTC, dated August 15, 2013, and Circular 92/2015/TT-BTC, dated June 15, 2015, PIT in Vietnam is calculated as follows:

Personal income tax (PIT) is carried out on a withholding basis; employers will withhold the PIT at a required percentage of their employees’ personal income.

Income paying entities are responsible for PIT finalization on behalf of their employees at the end of the year — on the condition that individuals have income only from wages and remuneration under a labor contract with a term of at least three months and are currently employed at the time of authorization for PIT finalization.

Each employee is required to obtain a separate tax number (tax code) and declare dependents eligible for tax reduction. If the employee’s tax liability is greater (or less) than the sum of tax paid during the year, employees could either complete their own tax finalization returns, or authorize an entity to perform tax finalization on their behalf.

The annual tax finalization on employees’ taxable income must be submitted to the relevant tax authorities no later than 90 days from the last day of the fiscal year.

WORKING HOURS & OVERTIME

Working hours

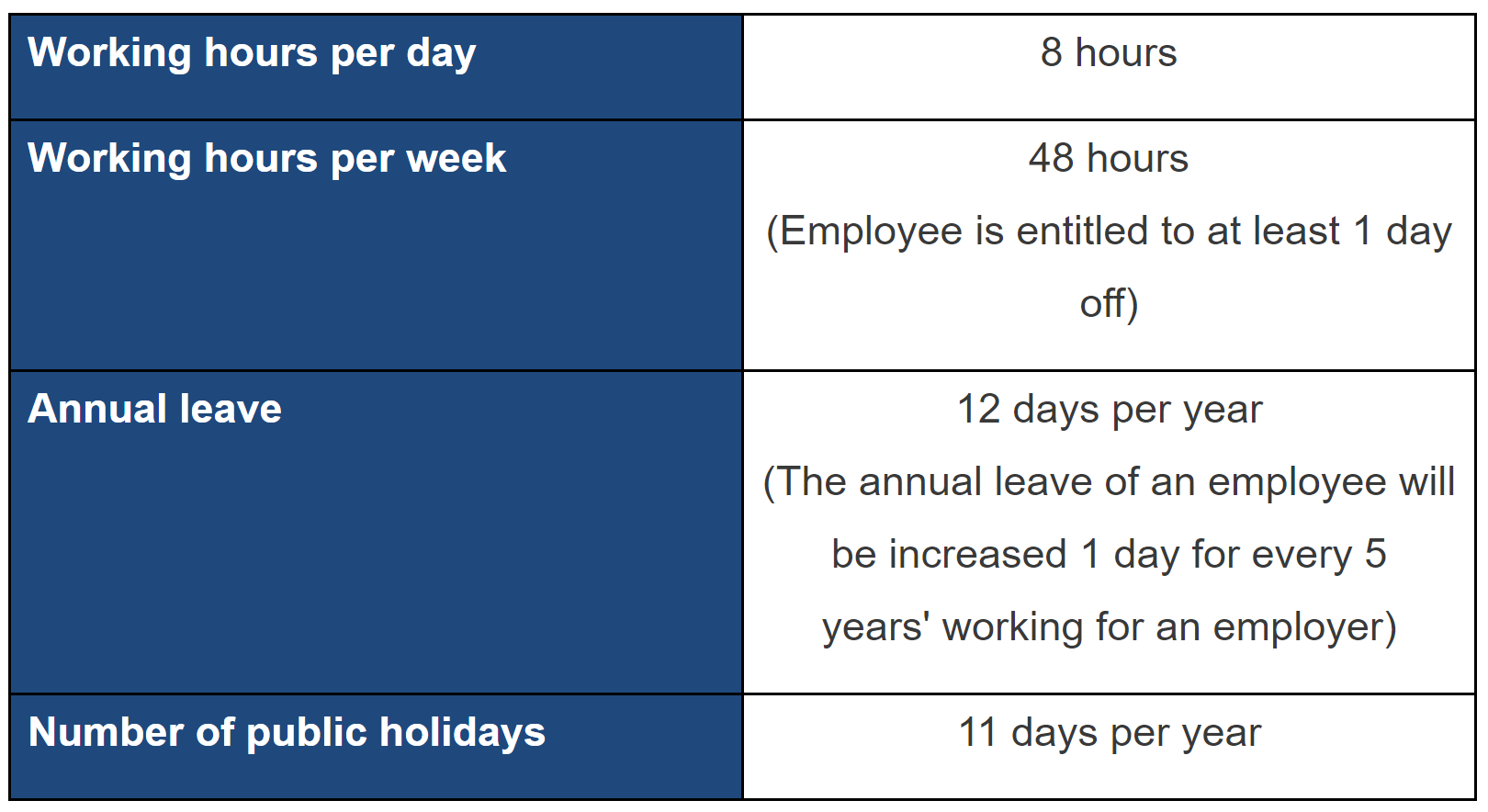

According to Article 105 of the Labor Law, the normal working time is as follows:

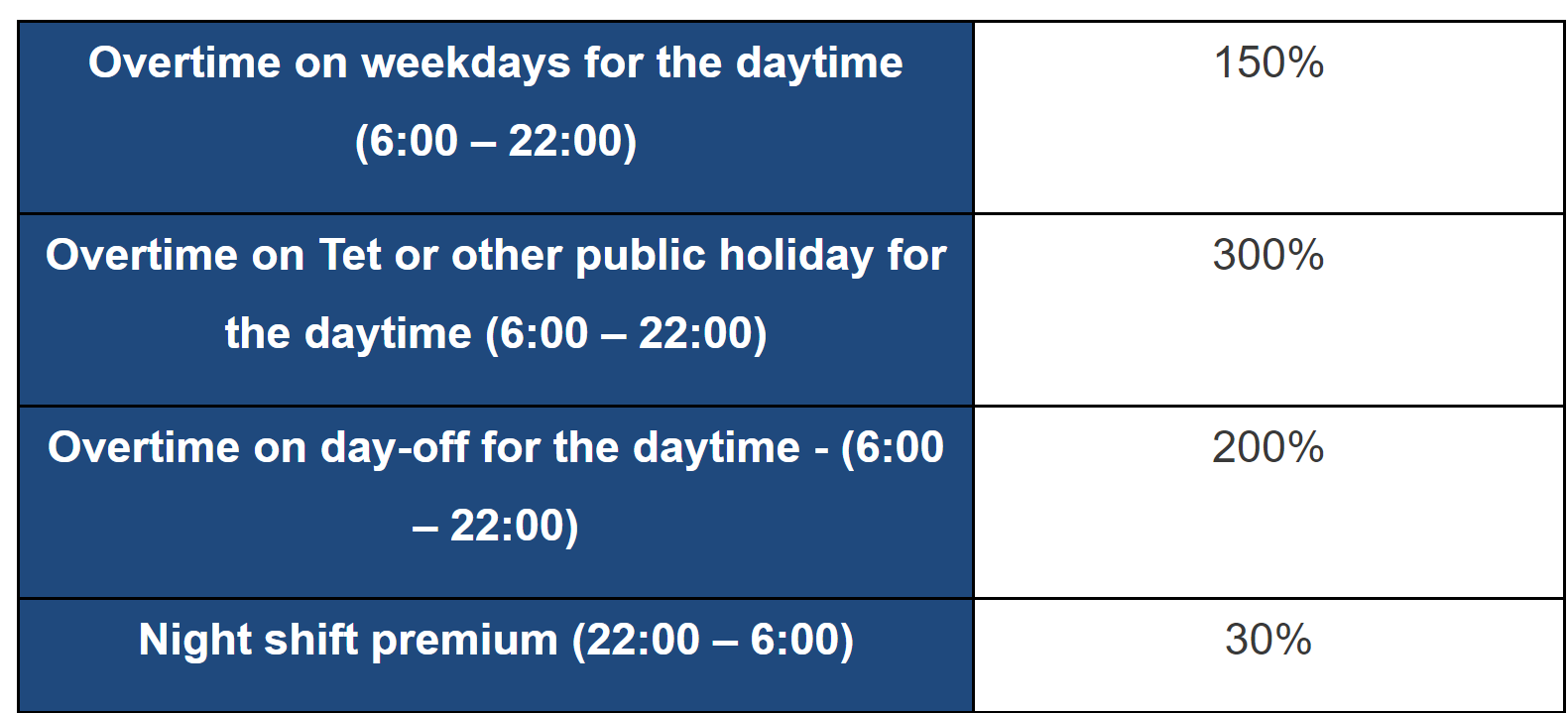

Overtime & Shift Premiums

According to the provisions of Clause 1, Article 98 of the Labor Law

*Note: The maximum permitted overtime hours is 300 hours per year; exceptions are subject to the appraisal and approval of relevant authorities.

To know more about the incentives for foreign manufacturers in Vietnam and receive free support (legal consultancy, HR consultancy, …) from BW, feel free to contact us via our hotline (+84) 28 710 29 000 or by email at enquiry@bwidjsc.com.