[5 min read]

“Vietnam’s outlook is one of the brightest in Asia,” according to UBS economist Mr. Edward Teather. Indeed, per the General Statistics Office of Vietnam, the country was remarkably experienced positive growth of 2.91% in 2020 despite the impact of the coronavirus pandemic.

By maintaining stabilized macroeconomic conditions over the years and being acknowledged as a successful country in controlling COVID-19, Vietnam is poised to rebound and accelerate its economic growth over the next several years. Standard Chartered Bank forecasts that Vietnam’s economic growth will rebound to 7.8% in 2021. An uplift in purchasing power as market sentiment is gradually improved and a continued growth in the industrial production index will be prime motivations for the country’s development post-COVID-19.

If you are looking for opportunities to invest in this dynamic Asian economy, here are 10 helpful tips that we have compiled.

1. Look for a reliable and savvy consultant with local insight

To understand all of the factors related to a country’s business environment, legal corridors, human resources or investment registration procedures, enterprises are advised to find a reliable and savvy consultant with local insight. The complexity of the Vietnamese tax system, inconsistency in the application of legal regulations and inability to fully grasp restrictions on trade and law can pose substantial obstacles to investors. With current market accessibility, businesses can have a wide range of options in picking out a consultant based on their budget from top-tier organizations such as Baker McKenzie, Boston Consulting Group and Dream Incubator, the big four consulting group that includes KPMG, EY, PwC and Deloitte, as well as other entities such as AASC, CPA, Mazars and Kreston, among others.

2. Use a law firm to participate in all procedures that need legal consultancy

In a new country, the culture, laws and operating procedures may be completely different from the investor’s home country. Therefore, getting a partner to support the implementation of legal regulations will help businesses ward off many risks and pressures. In fact, several projects in Vietnam that are undergoing time-consuming procedures have to wait more than one year to receive investment registration certificates and land-use certificates. For projects under the licensing authority of the Prime Minister, the duration can be even longer. In order to speed up administrative procedures, enterprises need to acknowledge the provisions of investment law and have an appropriate consulting from law firms. Some law firms you work with include Baker McKenzie, VILAF, Phuoc and Partners, Dan Viet Law and Minh Gia Law, among others.

3. Choose a strategic location for business set-up and select a strategic location for business and production set-up

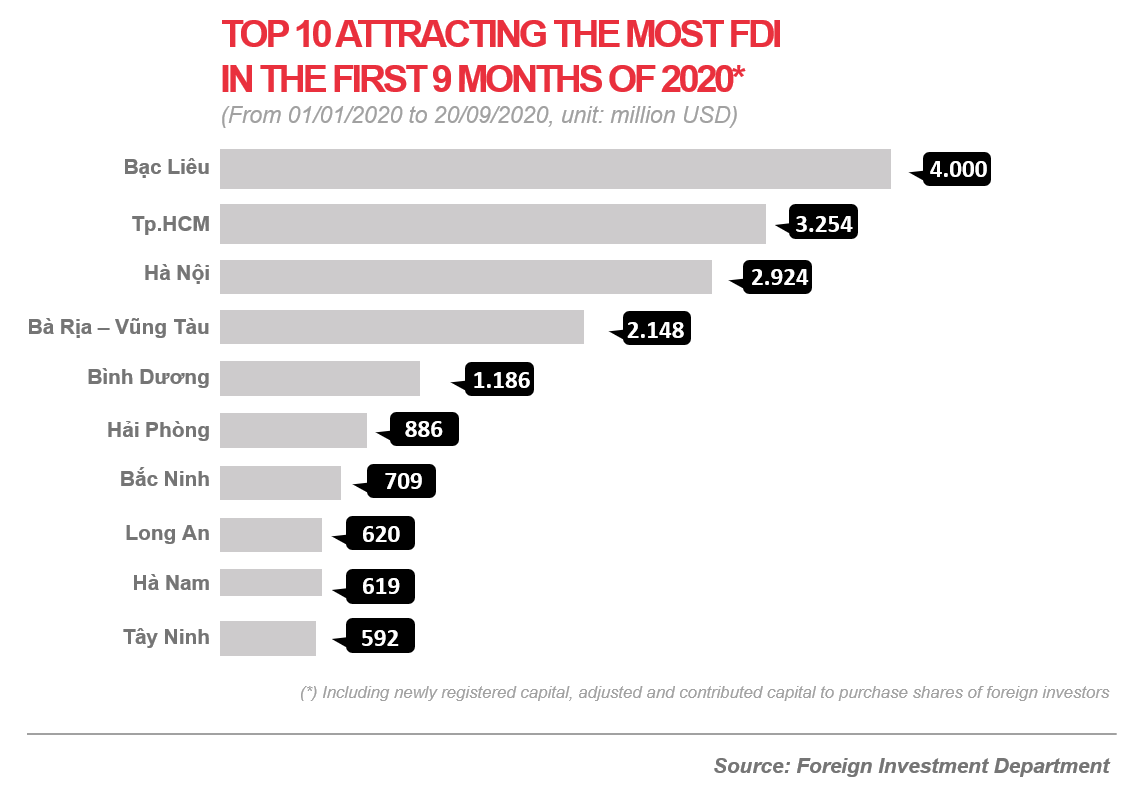

For example, we often receive requests from customers for a location that is under a two-hour drive to Hanoi/Ho Chi Minh City and international seaports/airports. In addition to distance requirements, infrastructure may be an element that investors also need to consider. If the surrounding infrastructure is well developed or the location is in a key infrastructure investment area, land supplies that are currently considered undesirable with low rental fees and competitive labor costs could become ideal for trading activities in the future. If you have not determined an appropriate destination, referring to the list of provinces/cities attracting the most FDI can be a good idea. In 2019, the 10 leading provinces/cities in attracting foreign investment included Hanoi, Ho Chi Minh City, Binh Duong, Dong Nai, Bac Ninh, Hai Phong, Tay Ninh, Bac Giang, Ba Ria – Vung Tau and Ha Nam.

4. Recruit Vietnamese people for your board of directors to have better communication with related ministries and agencies.

It is necessary to understand the culture and business norms in your host country. Indigenous staff will help businesses to shorten how long it takes to adapt to the culture and also accelerate the connection with the local business community.

5. Strictly follow government regulations on construction permits, fire prevention, wastewater treatment and environmental impact assessments during construction time to avoid unexpected costs

Click HERE for further information.

6. Add 10% of contingency cost in construction to avoid overbudget

There are costs that are hard to anticipate. These costs can be a result of construction re-planning, rising costs of foundation/pile construction due to local soil conditions and/or additional expenses for soil reinforcement to avoid subsidence.

7. Have a quality control department from your home country or organize additional training for your staff to avoid discrepancies in specifications between countries.

This measure helps businesses ensure to product quality, avoid risk of product recalls and damage compensation that is currently happening in the current export market.

8. Use factories for-rent instead of renting land to shorten implementation time, free up cash flow and freely expand on demand

Find out more about the benefits of the ready-built factories HERE.

9. Do not solely count on minimum wage when recruiting your labor force

Add 25%-30% of the minimum wage to make the job more attractive to employees compared offers from competitors.

10. Use international payment banking services to sidestep difficulties in paying/receiving international transfers or issuing LC or escrow accounts for export consignments

Foreign banking institutions that have branches and representative offices in Vietnam are HSBC, Citigroup, Shinhan and Standard Chartered, among others.

In addition, VAT refund procedures for manufacturing enterprises are still confusing and could result in inconveniences related to tax arrears. Therefore, enterprises should learn and take advantage of legal instruments to comply with all tax rights and obligations.

Vietnam is the 10th best country for expatriate employees to live, work and raise a family, according to a new HSBC survey. Over the years, the quality of Vietnam’s skilled labor in the fields of high technology, biology and mechanical engineering has increasingly improved. Therefore, it is more convenient for businesses to find and attract skillful human resources by setting up production in Vietnam.

To learn more about policies, receive advice for foreign manufacturers in Vietnam and obtain free support from BW, please contact our hotline (+84) 28 710 29 000 or email enquiry@bwidjsc.com.