[6 min read]

The trade tension that is stretching into its fourth year has fostered a wave of shifting production to countries outside of China. Meanwhile, Thailand and Vietnam are considered as two promising destinations for foreign manufacturers – with Vietnam gaining a more competitive advantage over its Southeast Asian peer for the following reasons:

1. Population

According to the World Bank, Vietnam is undergoing a rapid transformation in population and social structure. Vietnam’s population now stands at more than 97 million (2020) and is expected to reach 120 million by 2050.

Currently, 70% of the country’s population is under 35 years old and the average life expectancy is nearly 76 years — the highest figure among countries with similar income in Southeast Asia. Vietnam’s Human Capital Index (HCI) ranks 48th out of 157 countries and territories and second in ASEAN, just after Singapore1.

Thailand now has a population of approximately 70 million. As reported by the United Nations (UN) last year, the fertility rate in Thailand dropped to roughly the same as Switzerland and Finland, which are two developed countries that have experienced an ongoing decline in their fertility rates for many years. The UN forecasts that more than a quarter of Thailand’s population will be over 60 years old by 2030. According to the International Monetary Fund (IMF), the decline in Thailand’s national workforce will deteriorate the country’s economic growth for the next two decades2.

2. Advantages from free trade agreements

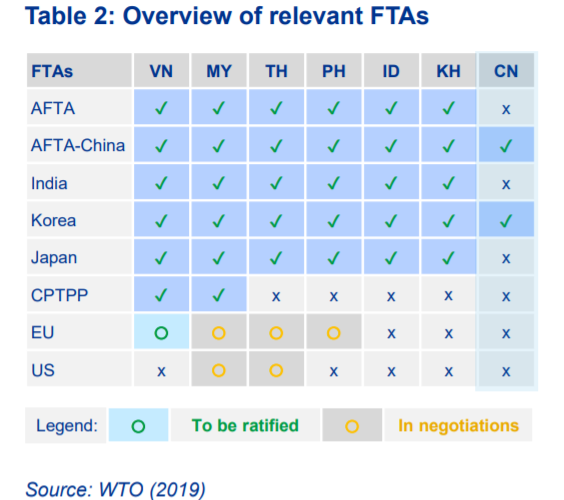

Vietnam is gradually expanding its competitive advantage by entering a large number of free trade agreements (FTAs) compared to Thailand and other countries in Southeast Asia (details are shown in the table below).

According to the Ministry of Industry and Trade, one year after coming into effect, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has been beneficial to Vietnam’s economy. For example, in the first 10 months of 2019, Vietnam’s exports to the markets of member countries under CPTPP exhibited a positive growth rate.

Thanks to the unfettered market access to the CPTPP nations, Vietnam’s exports to Canada and Mexico — two countries with which Vietnam does not currently have FTAs — rose significantly. Specifically, in the first 10 months of 2019, exports to Canada increased by 28.6% while exports to Mexico increased by 29%.

Although Japan is not a new market with an FTA with Vietnam, thanks to the impact of the CPTPP, benefitted from tax reduction and export turnover also increased by 8.9% on May 10, 2019.

In addition, being the first country in Southeast Asia to sign a bilateral trading agreement with EU market — the Vietnam-European Union Free Trade Agreement (EVFTA) — has significantly promoted Vietnam’s economic advantages over Thailand.

According to research by the Ministry of Planning and Investment, Vietnam’s exports to Europe after EVFTA come into effect is expected to grow by about 42.7% in 2025 and 44.37% in 2030 compared to without the agreement.

Meanwhile, CPTPP will establish one of the world’s largest economic blocs in terms of market size with a substantial share of about 13.5% in global GDP while also developing giant market across continents.

3. Strong domestic consumption growth

As the country’s economic conditions have swiftly improved, Vietnam’s per capita GDP tripled from more than USD600/year in 2005 to approximately USD2,800/year in 20193. The increase in income enables consumers to bolster their purchasing power. According to a World Bank report, Vietnam’s middle class currently accounts for 13% of the nation’s population and is anticipated to rise to 26% by 2026. Vietnam is among the top five countries in the region, including Thailand, Malaysia, Indonesia and the Philippines, to have soaring growth in its middle-class population. According to the World Bank, the middle class in Vietnam is defined as a group of people having a living standard of over USD15/day.

According to the National Center for Socio-Economic Information and Forecast (NCIF), the boom in middle-class spending will facilitate an increase in national consumption expenditure and hence economic growth4.

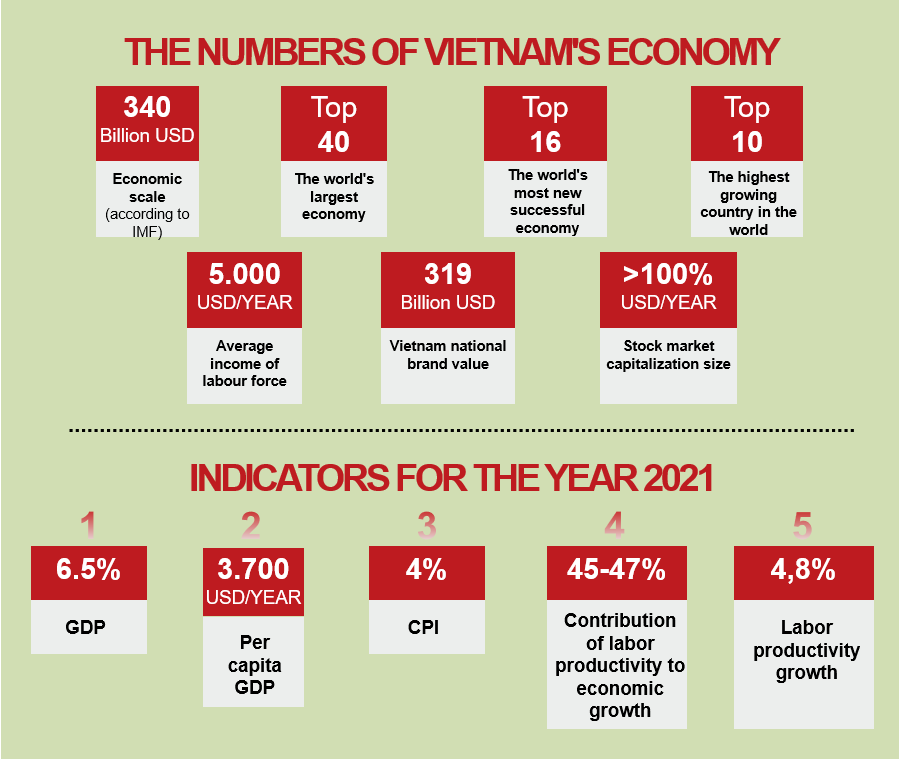

Vietnam is the only country in the six Southeast Asian economies to achieve positive growth in 2020. Recently, S&P Global forecast that Vietnam will attain a robust economic recovery in 2021 with a GDP growth rate of 10.9%, — more than any other country in the Asia-Pacific region — following a 2.91% uptick in 2020.

In the meantime, the growth prospects of other ASEAN economies look bleak. Thailand’s GDP is expected to drop by 6%, Singapore by 5.7%, Malaysia by 3.9%, the Philippines by 3.5% and Indonesia by 1%. As reported by Bloomberg in its 2021 outlook, Vietnam should be among the fastest-growing economies in ASEAN with an 8.1% GDP growth rate while Thailand ranks last with 4%5.

4. Political stability

Since the 1932 coup that turned the Kingdom of Siam into a constitutional monarchy, Thailand has been continuously swept up in a spiral of political crises. Social unrest in Thailand due to decades of internal dissension was exacerbated by COVID-19 as areas that had been affected by political instability were seriously affected by the pandemic, including investment and consumption expenditures of the private sector.

On the contrary, one of the key factors that make Vietnam attractive to manufacturers is its political stability. The success story of Vietnam in luring foreign investment is attributed to an effective financial management system surrounding tax, accounting and foreign exchange control. The process of investment registration and tax administration in Vietnam is decentralized and has gradually improved as provincial and city authorities have considerable discretionary power on how businesses are established and managed.

In 2019, Global Finance Magazine published a chart showing the safest and most dangerous countries in the world with data compiled from the World Economic Forum and the Global Peace Institute. In this chart, Vietnam was placed at 83 of 128 countries with a safety index of 11.15 points — above Thailand with 12.27 points. This ranking is quite understandable as Vietnam has a stable political system with little violence or territorial disputes over the past few decades while human security indicators have also steadily improved. Meanwhile, in spite of its high human security index, Thailand is frequently prone to natural disasters, floods and political violence6.

5. Geographical location

Vietnam is endowed with a favourable geographical location that provides ideal accessibility to important global commercial sea routes, thereby opening up opportunities to develop maritime transport — especially for logistics services.

Vietnam is directly adjacent to the East Sea — a crucial trade “bridge” on the global marine map. Among the 10 largest waterways in the world, one route runs through Vietnam and five routes are linked to the country. It is estimated that 250-300 ships go through the East Sea on a daily basis with 50% at a tonnage of over 5,000 DWT and nearly 15%-20% at a tonnage of over 30,000 DWT. Put together, these vessels account for a quarter of the total global vessel tonnage.

In addition, as a country adjacent to China, Vietnam is the first choice in Southeast Asia for foreign investors pursuing a China+1 strategy to reduce costs and diversify supply chains. Many manufacturers are extending their production lines to countries situated next to China as operating costs in the Chinese market are constantly soaring7.

The shortest distance between major cities of Thailand and China is 1,687 km (Pak Kret → Guangzhou). On the other hand, Vietnam is adjacent to China and in close proximity to the Guangdong manufacturing powerhouse (722 km Haiphong → Guangzhou). Vietnam’s more extensive coastline makes it particularly ideal for the China+1 one structure as well as for any business that needs to source goods from China.