[4 min read]

Insurance is the responsibility of every enterprise using labor. However, not all employers are aware of the regulations related to insurance — especially those that are newly operating. BW’s legal consulting experts can provide crucial information regarding insurance in Vietnam.

There are three types of insurance that are required for all employees in Vietnam:

– Social insurance: This type of insurance covers employees’ benefits such as sick leave, maternity leave, benefits for work-related accidents and occupational diseases, pension allowance, and mortality allowance.

– Health insurance: This allows employees to undergo medical examinations and inpatient and outpatient treatments at authorized medical facilities.

– Unemployment insurance (which replaces severance pay): This will be paid to workers at an amount that depends on the amount of time they and their previous employers contribute. The monthly unemployment allowance is 60% of the average salary in the last six months of work.

What are an enterprise’s responsibility regarding insurance for recruiting local and foreign labor in Vietnam?

Businesses should pay attention to the following notes:

– Social insurance and unemployment insurance are only required for Vietnamese employees.

– Health insurance applies to both Vietnamese and foreign employees working under Vietnamese Labor Law.

– For those whose contract is valid for more than three months or for an indefinite period of time, the employer will pay insurance — meaning that enterprises must register and pay for their employees’ insurance at the Department of Labor, Invalids and Social Affairs.

INSURANCE CALCULATION

The increase in regional minimum wages in 2020 from VND150,000-240,000 per month in comparison to 2019 also leads to the increase in the compulsory minimum insurance payment rate for employees and their employers.

From January 1, 2018, the monthly salary as the basis for social insurance payment will be the salary plus salary-based benefits mentioned in the labor contract as prescribed in the Labor Law. The maximum amount of salary to charge for insurance payment will not be greater than 20 times of the basic salary.

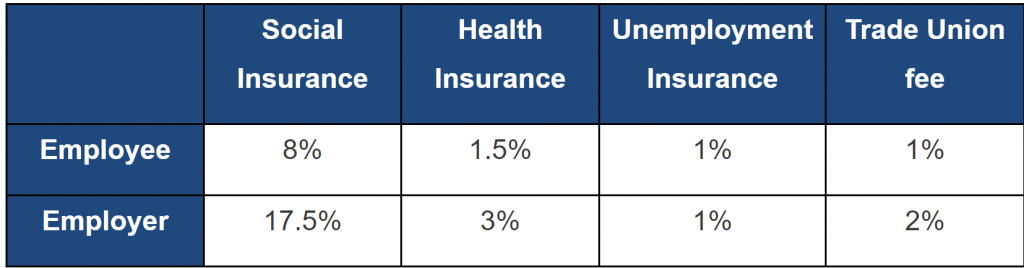

Generally, for local workers it can be calculated as below:

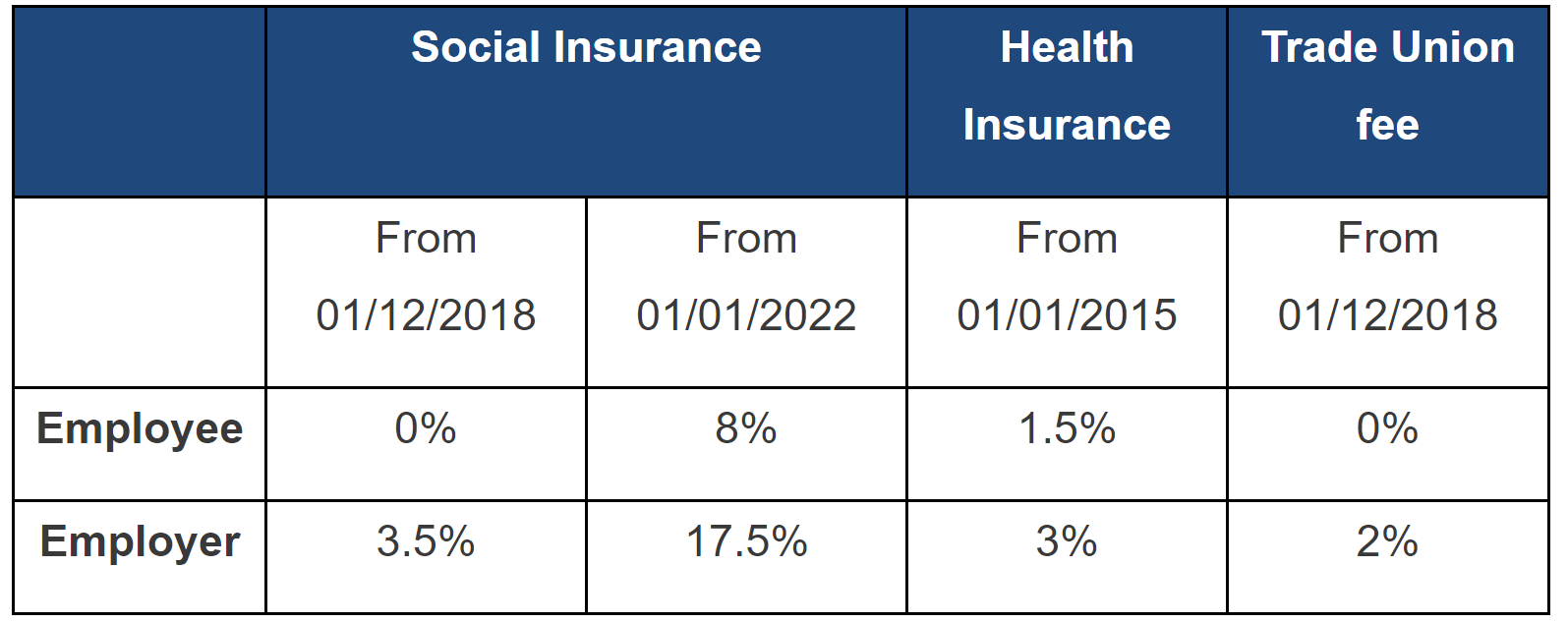

For foreign workers:

To gain more information about manufacturing in Vietnam and to receive free support from BW (legal consultancy, HR consultancy,…), please contact our hotline (+84) 28 710 29 000 or email us at enquiry@bwidjsc.com.